Purse Strings and Pay Cheques: Britons’ Attitudes Towards Money and Saving

Key Insights:

- Some 74% of adults in the United Kingdom have a long-term financial plan, with 48% confident that a salary between £40,000 and £60,000 would be enough to live comfortably.

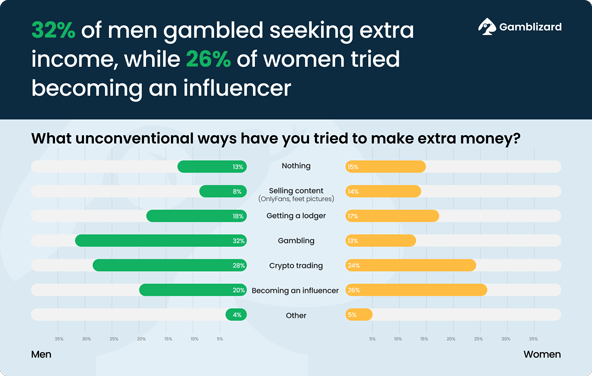

- Seeking extra income, 32% of men have tried gambling, while 26% of women have sought success on social media.

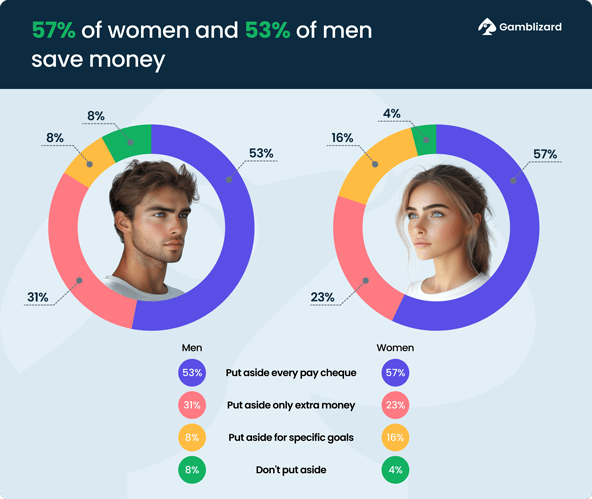

- When it comes to money, saving is also common, with 57% of women and 53% of men now saving consistently.

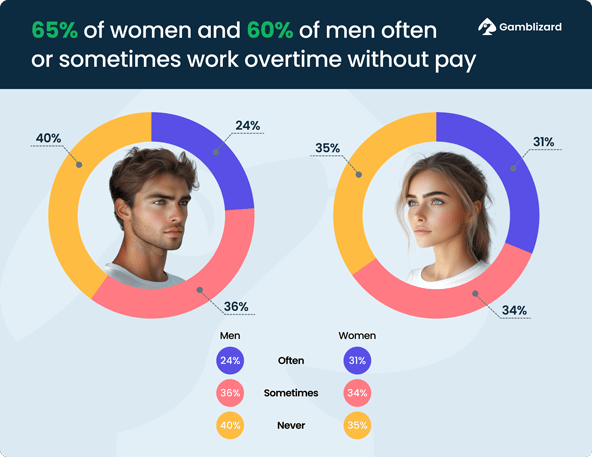

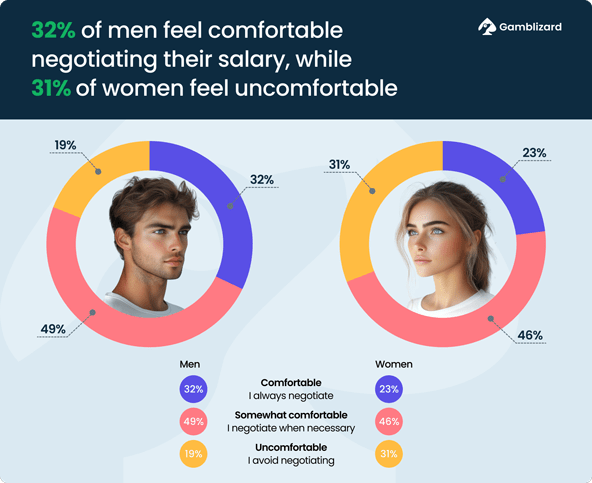

- Money remains taboo in the workplace, with 63% working overtime without pay and 25% admitting negotiating their salary causes them discomfort.

- Money also plays an important role in relationships, with couples divided over whether to share finances.

Money makes the world go around, but we all have different ways of looking at it. Is it a source of power? But does it buy us freedom, or is it just a means to have fun? How much is enough? Is it okay to discuss money openly? And are shared finances a dealbreaker when it comes to love?

Gamblizard surveyed 2000 adults in the United Kingdom on their thoughts on earnings, spending, savings, and personal funds management – from retirement planning to shared bank accounts. The results show that while most Brits have a long-term plan to grow their wealth, there’s little agreement when it comes to money on a daily basis.

Saving, Spending, Succeeding: Financial Goals in the UK

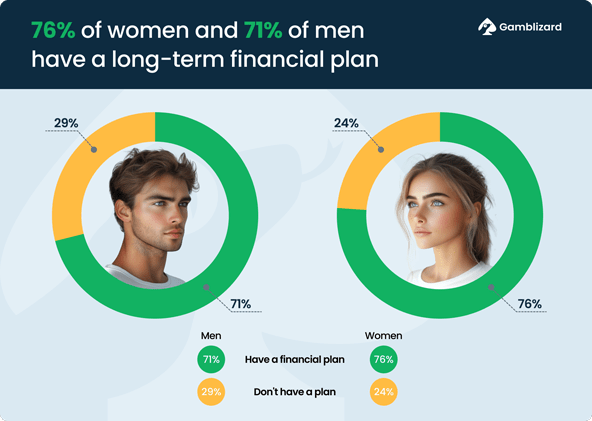

Times are tough, but Brits are still prioritizing their financial futures – with women leading the way. Some 76% of women say they have a long-term personal financial plan, compared to 71% of men.

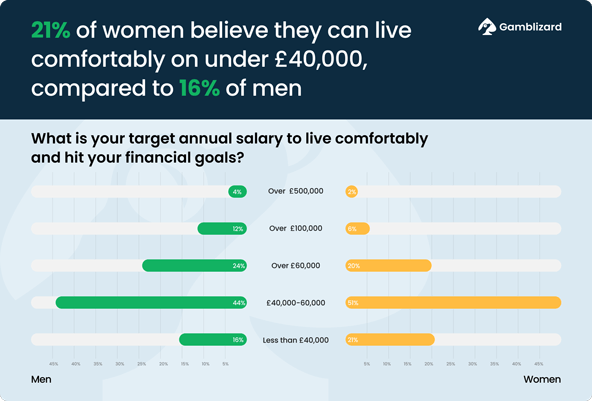

The aim isn’t necessarily fast cars and fancy cruises. In fact, 48% of Brits believe they can live happily on a salary of just £40,000 to £60,000. For many, a comfortable life comes at an even lower price, with 21% of women and 16% of men confident that a salary of less than £40,000 would suffice.

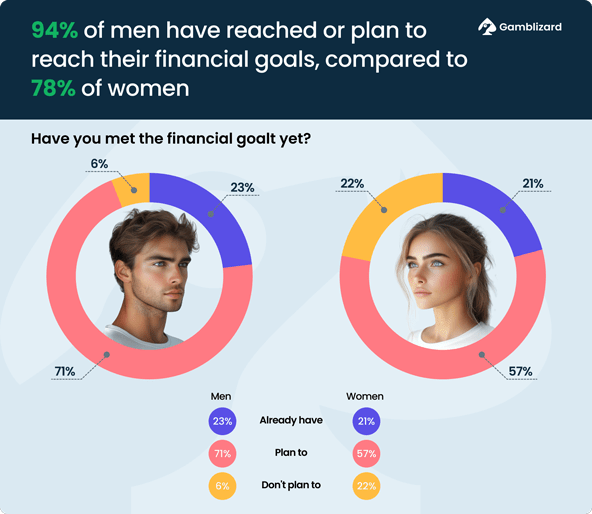

Women are less likely to set their ambitions high. Yet, they’re also less confident in meeting their long-term financial goals. While 94% of men already have or expect to hit their targets, just 78% of women have or believe they will.

The Road to Riches: How Brits are Building their Futures

Many aren’t relying on their salary alone. Looking for ways to earn extra money, men most often turn to gambling (32%) and cryptocurrency (28%). However, women are more likely to try their luck on TikTok and Instagram, with 26% having turned to social media to strike it rich.

But you don’t have to spend all your time looking for ways to earn extra income. By saving, you can let your money do some of the hard work. Some 92% of men and 96% of women are actively putting aside, with an average of 55% setting aside a portion of every paycheque and letting compound interest work its magic.

Talking Money in the Workplace: Taboo or Transparency?

Can you be forced to work overtime? UK law states only if your contract says so, yet most people do anyway. And 65% of women and 60% of men do it at least occasionally – without any additional pay. But is that the Briton’s stiff upper lip showing, or is it just discomfort over discussing money in the workplace?

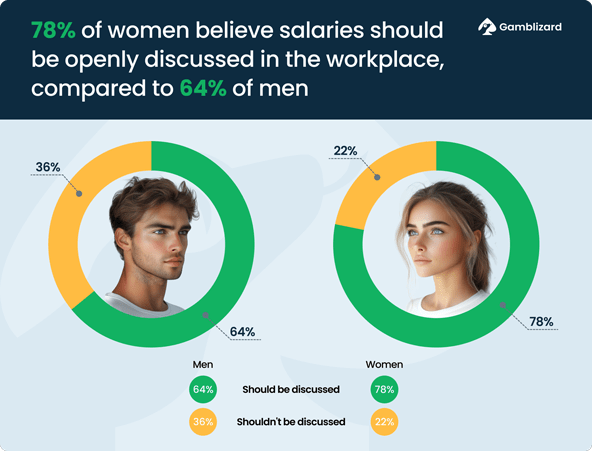

Money is off the table for many when it comes to workplace conversations. The truth is that 32% of men and 31% of women admit that even negotiating their salary causes discomfort.

But just because it’s uncomfortable doesn’t mean people are against it – regardless of what their bosses say. As much as 78% of women believe discussing salary at work in the UK should be the norm, and 64% of men agree.

Balancing Love and Money: Splitting Bills or Splitting Up?

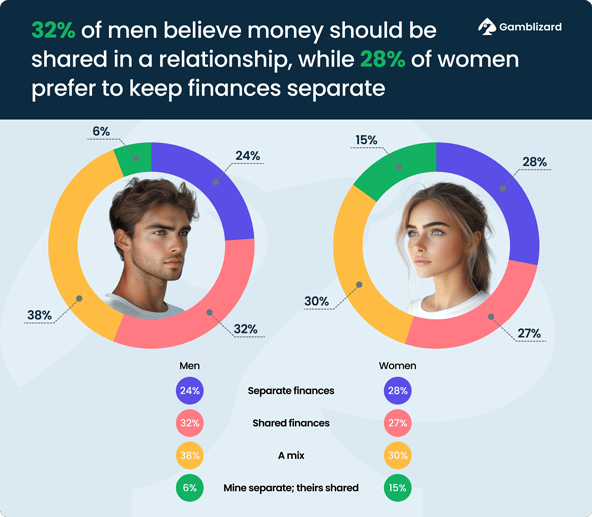

When it comes to shared finances in marriage and relationships, many are far from united. While 32% of men believe finances should be fully shared, 28% of women prefer to keep bank accounts separate. However, relationships require compromise, and most couples can find a middle ground, with roughly 34% sharing a mix of shared and personal finances.

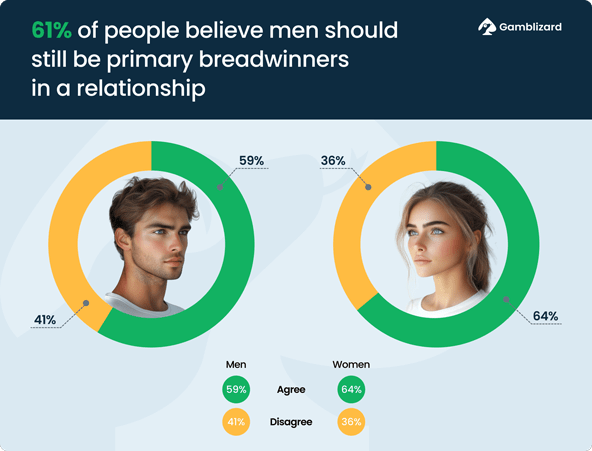

Where it was once commonplace for men to work and for women to take care of the house, there’s little difference between the percentage of men and women in UK’s workforce today. Yet, despite shifting social norms, traditional views persist. Some 59% of men and 64% of women believe that men should be primary breadwinners in a relationship.

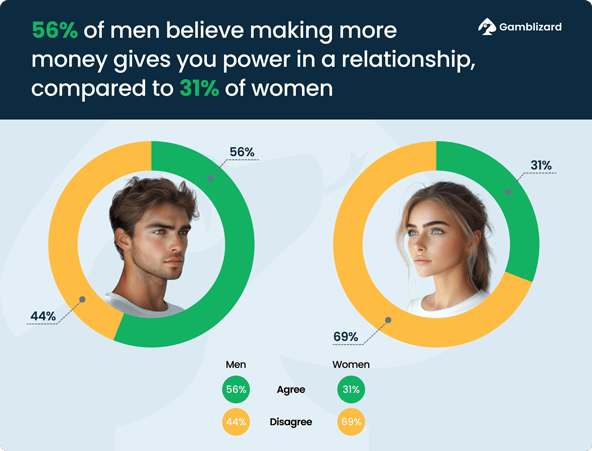

Why would men be so willing to provide for their partners? Because according to 56% of men, money is power.

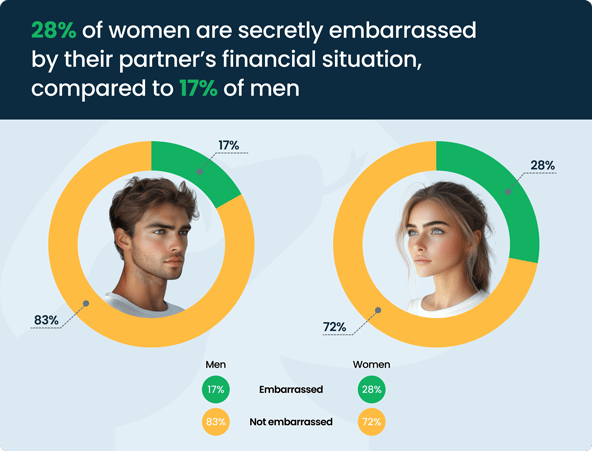

Money can’t buy happiness, but a lack of success and stability can cause dissatisfaction. Some 28% of women and 17% of men admit they’re secretly embarrassed by their partner’s financial situation.

Love or Liability? Financial Red Flags in Relationships

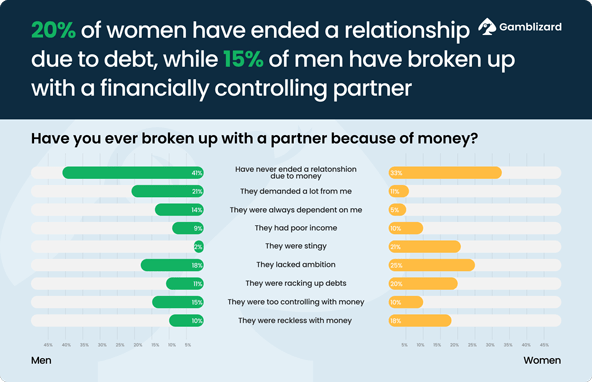

If you’re constantly searching where to borrow money instantly with no thought for how you’ll repay, building and maintaining relationships might prove difficult. 20% of women and 11% of men say they’ve ended a relationship because their partner was racking up debt. Likewise, 18% of women and 10% of men say they split because their partner was financially reckless.

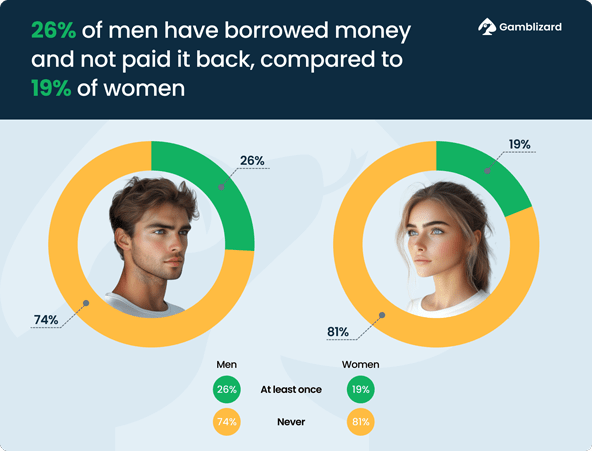

Borrowing money is not an issue. It’s perfectly normal to spend on a credit card, take out a mortgage, or make a big purchase, so long as you can pay it back. However, 26% of men and 19% of women admit they borrowed money and failed to pay it back.

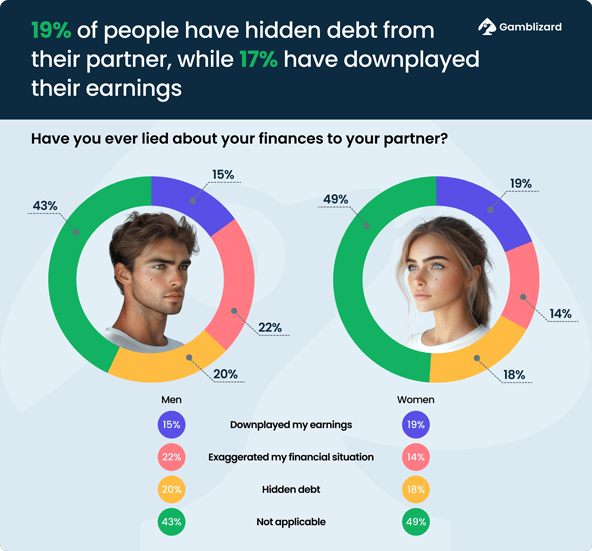

Being in a serious relationship means you’re in it together – in sickness, in health, and in finance. Yet, honesty isn’t always the go-to policy. Some 19% admit to hiding a debt from their significant other. Likewise, 22% of men say they’ve exaggerated their income, whether to impress their partner or improve their self-worth. In contrast, 19% of women say they’ve downplayed their earnings.

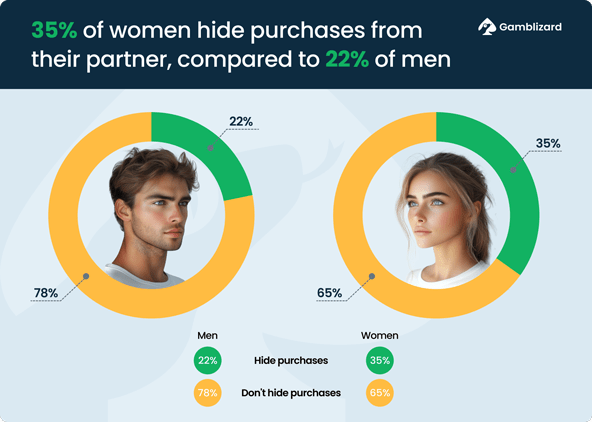

Relationships may be shared, but shopping habits? Not always. Some 35% of women admit they hide purchases from their loved ones, compared to 22% of men.