The Price of Being Queer: How Identity Impacts Financial Security

While financial milestones are difficult for most people today, queer communities often face challenges that go beyond inflation or interest rates. These barriers are rooted in rejection, exclusion, and survival. From lost inheritances to paying more just to feel safe, many LGBTQ+ individuals make financial decisions shaped more by identity than opportunity.

Gamblizard surveyed 2,000 LGBTQ+ adults about the real cost of queerness. The results reveal just how wide the gap is when identity and money intersect, highlighting the unique challenges faced in financial planning for LGBTQ+ individuals.

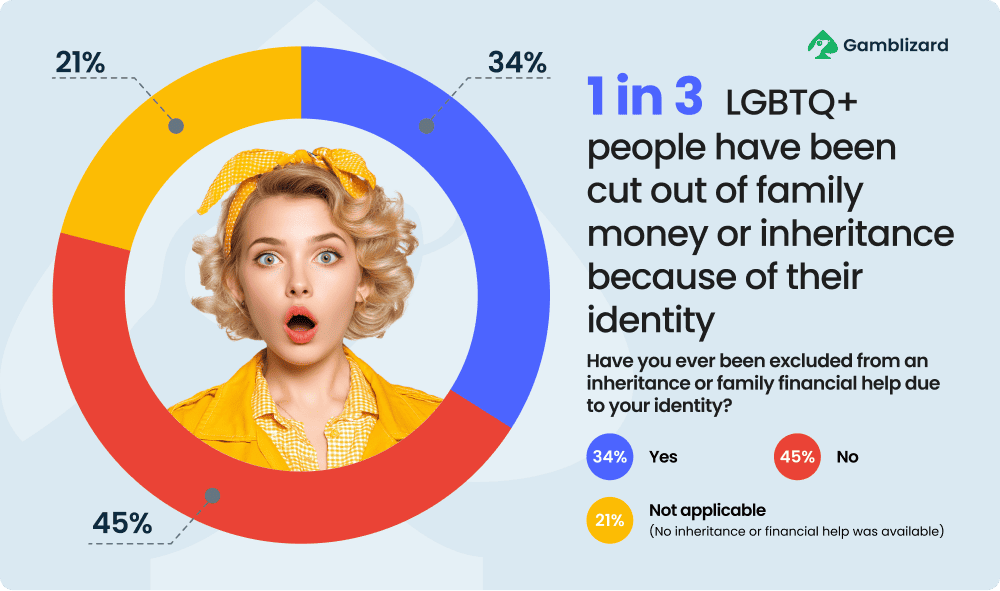

Cut Off and Left Out: Queer People and Family Wealth

Being open about who you are can come at a steep price. For 34% of queer adults, that meant being left out of family wealth or denied financial support entirely. It’s a quieter kind of erasure, but no less damaging.

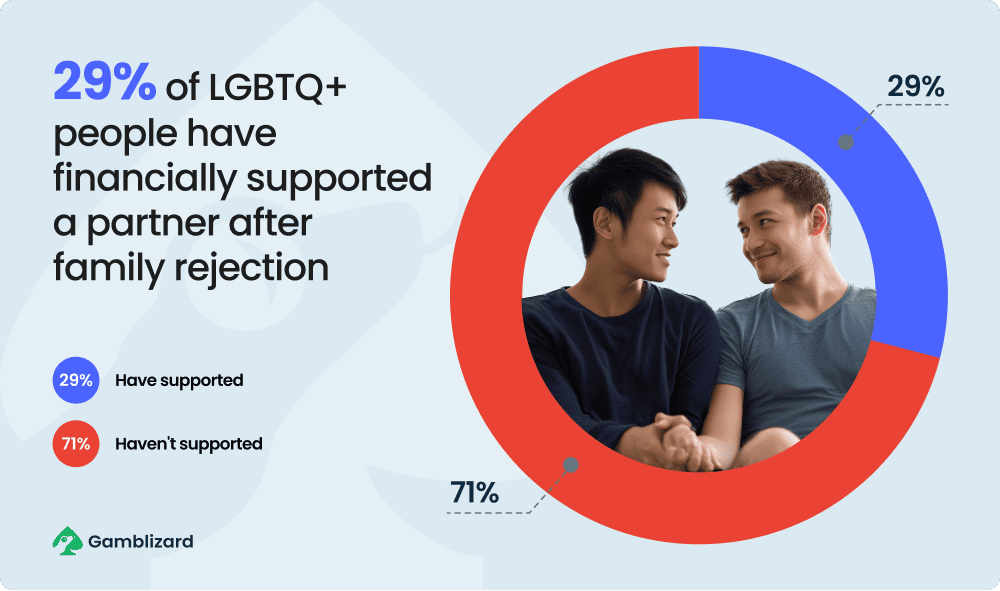

When one person gets cut off, another often picks up the slack. 29% say they’ve financially supported a partner who was disowned or denied help for being queer. These are costs many straight couples don’t even consider. This is why LGBTQ+ financial planning is more than just managing dollars — it’s about survival and support.

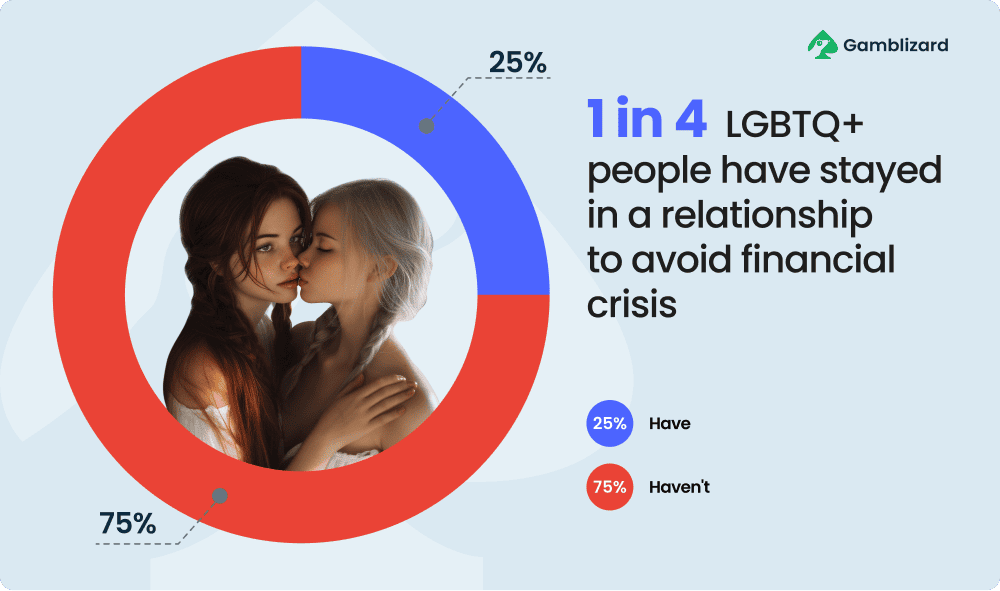

Sometimes love isn’t the reason people stay together — money is. 25% say they’ve remained in a relationship not out of choice, but because they couldn’t afford the alternative.

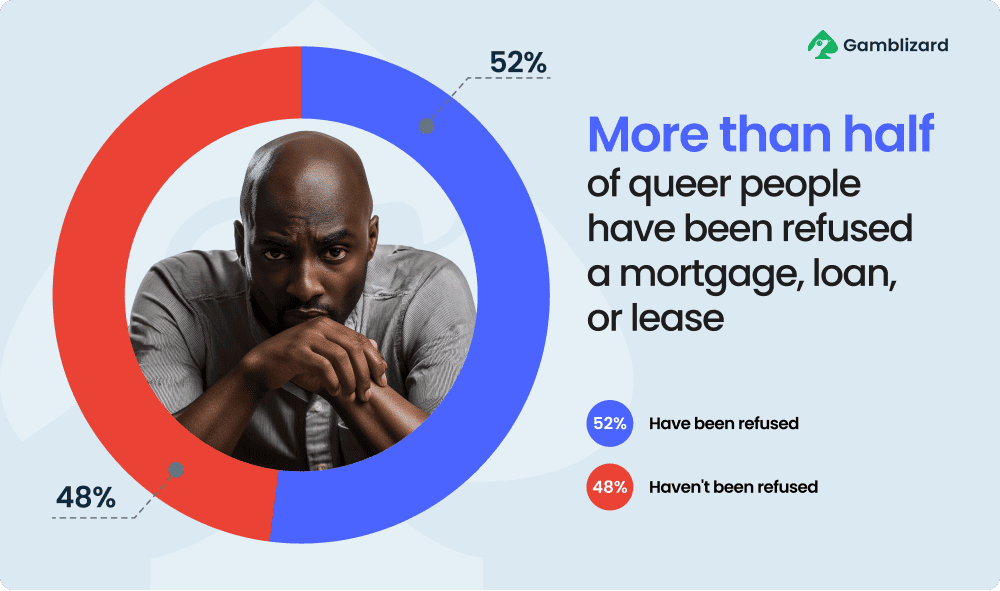

Barriers to Basics: Housing, Safety, and Health

Owning a home is supposed to be a sign of stability. But for 52% of queer respondents, bias still gets in the way. Denials often come without explanation, but the message is clear. This is why many turn to LGBTQ financial advisors who understand these unique challenges and can help navigate the complex path to homeownership.

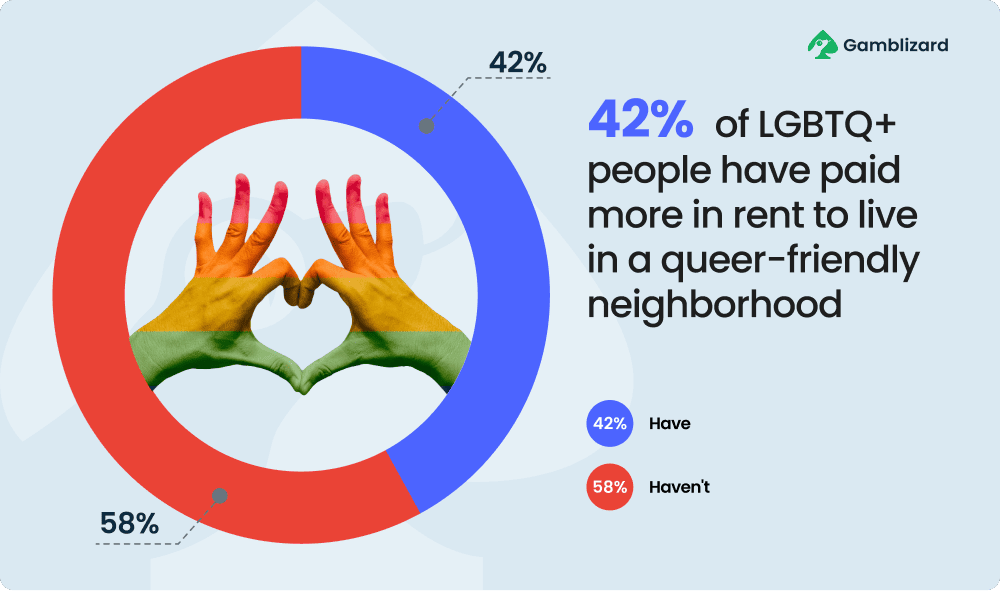

For many, safe spaces aren’t just comforting; they’re costly. Nearly half (42%) of LGBTQ+ renters say they intentionally pay higher rents to live in inclusive, affirming neighborhoods. Safety, it seems, comes at a premium.

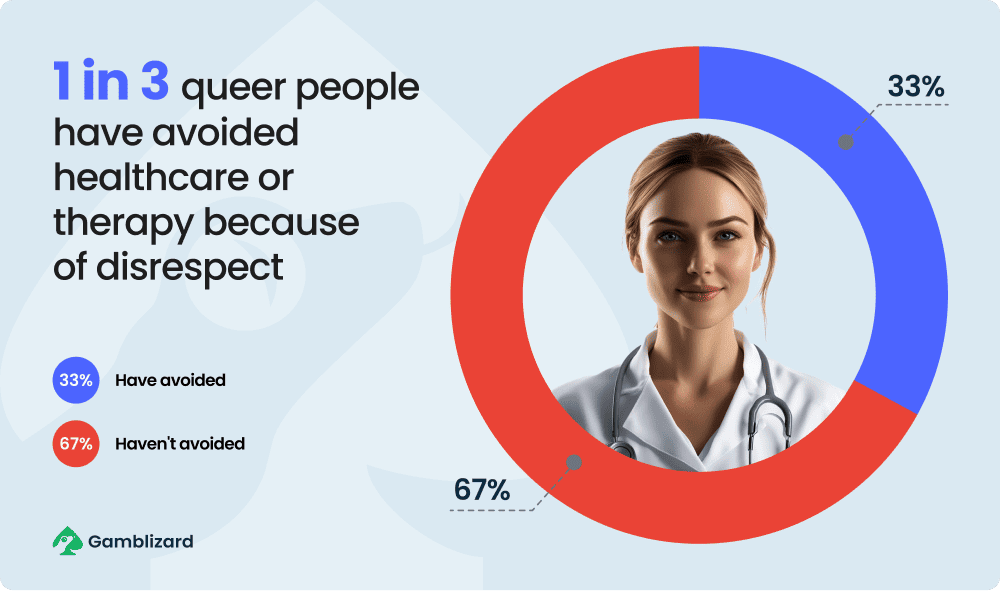

Even when mental and physical health are at risk, many queer people avoid care. One in three have put off seeing a doctor or therapist out of fear they won’t be treated with respect, adding long-term costs to already vulnerable communities.

LGBTQ+ financial planning: High Costs, Fewer Milestones

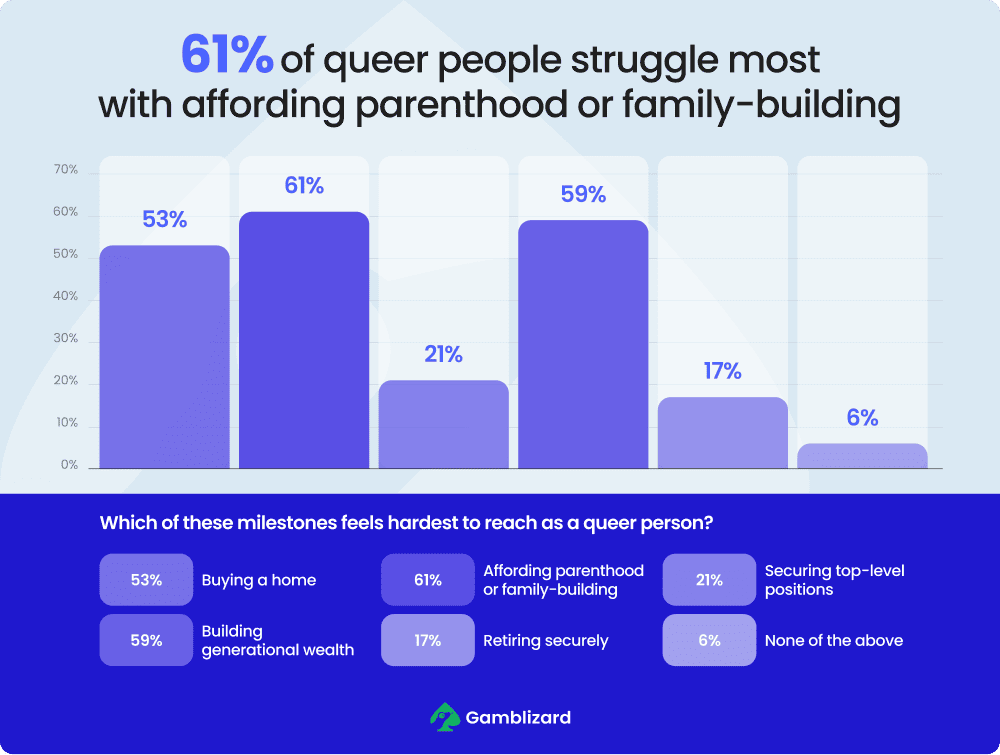

While 53% of LGBTQ+ respondents say buying a home is a major hurdle, even more (61%) point to affording parenthood or building a family as their biggest financial challenge. Between legal fees, fertility treatments, and adoption costs, starting a family often feels out of reach.

The gap doesn’t end there. With fewer financial safety nets, lower chances of receiving inheritance, and a higher cost of living, nearly six in ten queer people say building wealth that lasts feels out of reach. One in five also says that climbing to top-level positions remains a struggle.

Yet, if you’ve ever wondered how much money the LGBT community generates, here’s the thing: despite the challenges, queer individuals represent a powerful economic force. Research from LGBT Capital shows that the world’s LGBTQ+ annual spending power currently sits at $3.9 trillion, and it’s only growing.

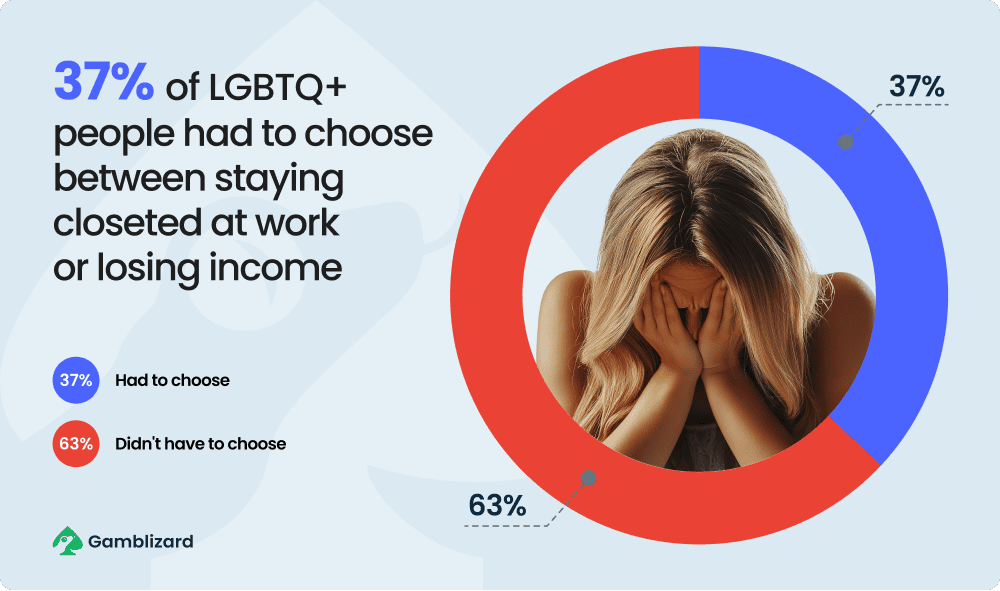

Career advancement should be about talent, but for queer people, professional success often comes at the cost of authenticity. Over a third (37%) say they’ve had to hide who they are to protect their job or earnings.

For LGBTQ+ individuals, money isn’t just a matter of earning or saving. It’s often about navigating exclusion, fighting for safety, and paying more to live openly. Unfortunately, the price of being queer remains high, and many face these challenges alone, which needs to change.

Meanwhile, connecting with knowledgeable LGBTQ financial advisors or exploring LGBTQ financial planning tips can help transform financial struggles tied to identity into a stronger foundation for long-term security.